Glamping has taken over the UK staycation market, becoming the more desirable getaway option to camping. With all the luxuries of a proper bed, private facilities, and all the mod cons, glamping offers holidaymakers the luxury of hotels, comfort of home, and adventure of getting away.

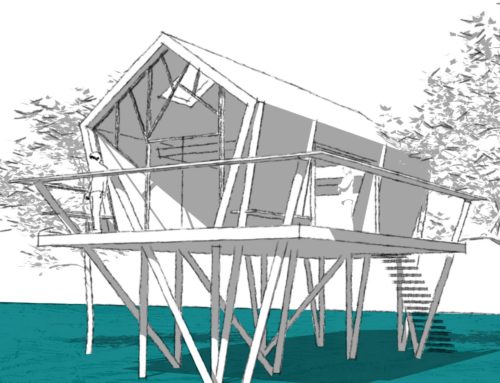

Landowners, farmers, and even homeowners are exploring the option of glamping; setting up a location or two to bring in additional income. And, of course, a contemporary treehouse presents the ideal glamping solution.

However, financing this investment, especially at start-up stage, may seem daunting. It doesn’t have to be though; with specialist advice and the right direction, all manner of people can finance their glamping treehouse, and quickly see sizeable return on investment (ROI) from their glamping business.

If you’re looking to begin your glamping business, purchase a treehouse, or would like to explore finance options, read on. Our experts at TRE3DOM – consultants for all things treehouse financing and planning permission – will guide you through the various options available to you.

Got questions? Check out our FAQs >

How Viable is A Glamping Business?

Glamping businesses are constantly cropping up across the UK. From singular garden pods to full sites filled with accommodation, the glamping sector comprises all level of start-up through to established businesses.

At TRE3DOM, we work with private landowners, farmers, and more to begin rental businesses and continuously achieve payback within two to three years. Not only is this payback beneficial for financing, but also for growing the business and diversifying existing offerings.

To get an idea of ongoing finance for glamping treehouses, owners can charge however much they desire, but the nightly rate for the UK is usually around £150-£350 and occupancy rates can easily range from 70% all the way to 100%! Of course, there are plenty of factors that can affect this, such as location, time of year, and unique offering – but there is certainly money to be made!

If you want to put a number to your vision, why not use our returns analysis calculator? Simply fill in the fields to get an estimate figure for ROI, yield, payback and more!

It is important to note, though, that glamping businesses do require constant management and attention. Those looking to start a glamping business must be prepared to put in the work on a daily basis to see the real results of their investment.

See more: What Kind of ROI To Expect With A Treehouse B&B Business

Glamping Business Finance Options

You don’t necessarily have to have the capital outright to begin your glamping treehouse purchasing journey. In fact, there are various grants and credit options available to you. We’ve given a brief overview of some of the most common options below.

For more information, download our dedicated treehouse financing & funding guide.

If you would like to find out more, or want to speak to an expert with experience in glamping business investment, get in touch with one of our friendly team!

Government Grants

There are numerous government grants available to a range of businesses. Following the pandemic, and various changes due to Brexit, the UK Government is helping rural communities and sustainable development within these areas in particular.

Could your rural glamping treehouse be eligible for a grant? Find out more from the Government website.

Local Authority Grants

It’s always worth talking to local authorities, as well as looking to the Government, to see what funding may be available. Even if not directly for the purchase and build of your treehouse(/s), there are often small business grants available which can be used to grow your business.

Crowdfunding

Crowdfunding is a popular way to raise funds for a project, charity, or initiative. In return for providing funds, depending on the method, those who give money may expect equity in your business in return for the funds.

Peer-to-Peer Lending

This is an increasingly common way to raise funds for businesses. Generally, the lender receives interest on top of the loan being repaid. There is risk involved, naturally, however there are specific trusted platforms, such as Folk2folk, that are targeted to rural communities.

Bank Loans

For any business venture, bank loans are available. In fact, borrowing by small and medium sized businesses has boomed in recent years, with lending increasing by tens of billions in 2020. It’s worth doing your research and shopping around for the best rates and deals; there are a lot of options out there!

Brokers

Sector-specialist brokers can offer expert advice and find the best loans depending on your needs. There are numerous brokers with specialisms in glamping loans, helping individuals and businesses across the UK achieve the required funds.

Finance Advice For Treehouse Glamping Businesses in The UK

If you’ve got the vision but aren’t sure where to begin, the friendly team at TRE3DOM can help. We help individuals and businesses realise their treehouse dreams, from concept to design, to finance and build.

From our treehouse planning permission consultancy service to our complete design and build process for contemporary structures, our team lend a helping hand at every stage.

Get in touch to begin your treehouse glamping business journey!

See more: Do You Need Planning Permission to Build A Treehouse In the UK?